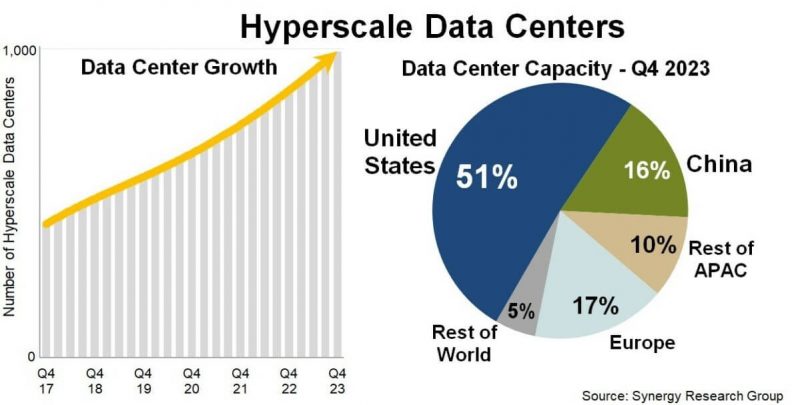

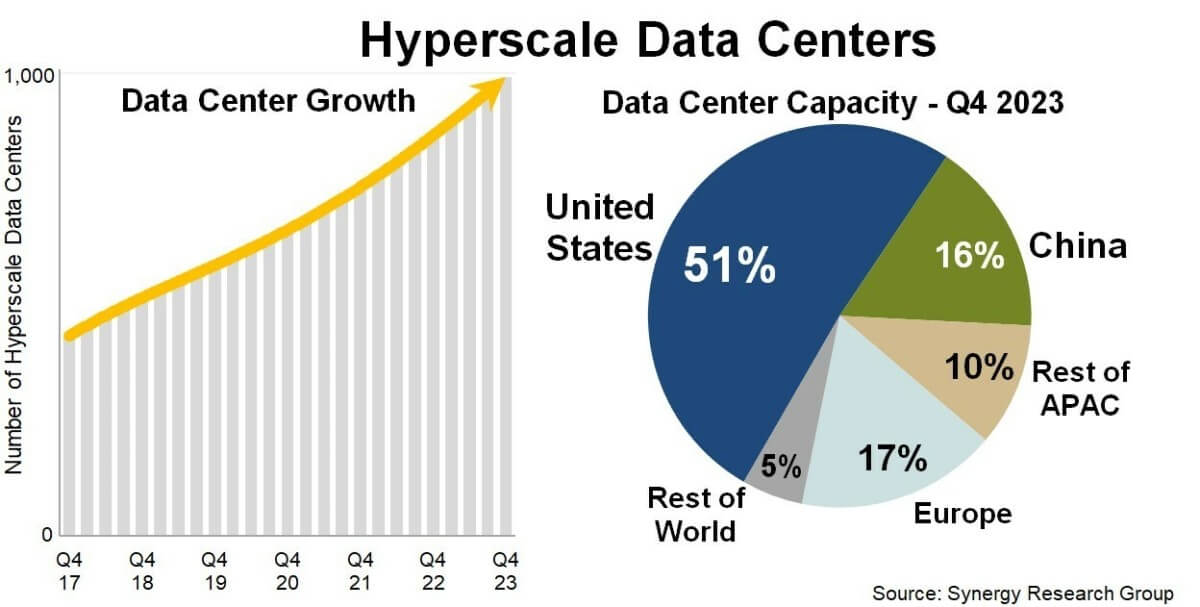

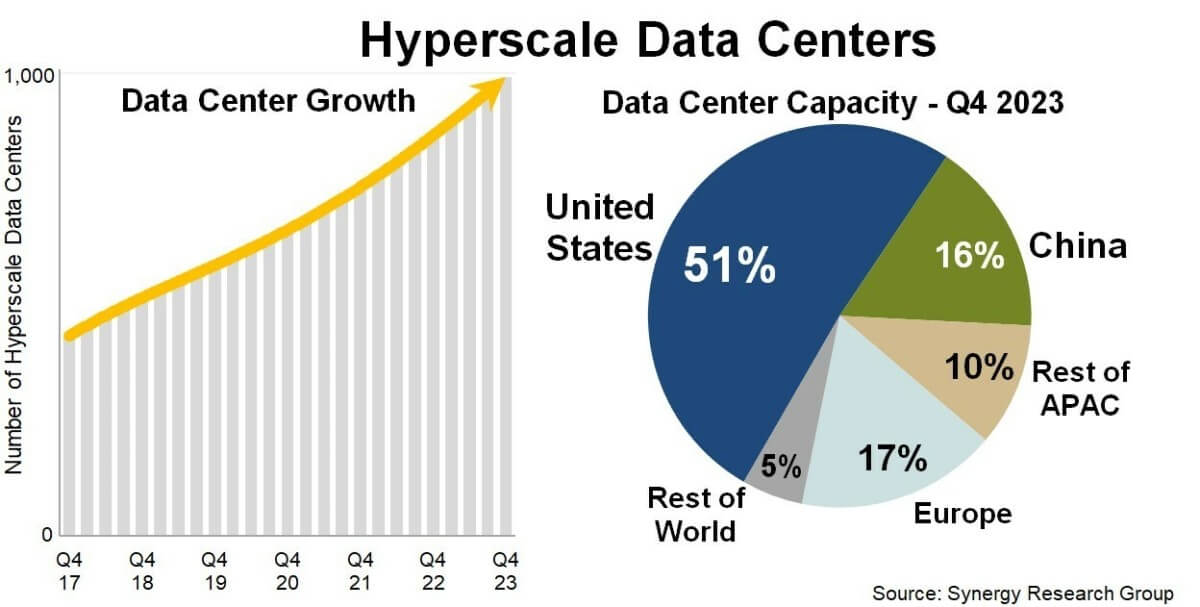

The fact that it only took four years for the overall capacity of these data centers to double – a trend driven by the growing size of facilities and the growing demands of cutting-edge technologies like generative AI – marks this milestone as a significant acceleration in growth.

These hyperscale data centers, pivotal in handling vast amounts of data for cloud and Internet services, are predominantly concentrated in the United States, which houses 51% of the global capacity, measured in megawatts (MW) of critical IT load.

Europe and China are significant players as well, each accounting for about a third of the remaining hyperscale capacity. This geographic distribution highlights the strategic importance of these regions in the global data infrastructure.

GenAI Technologies

Looking to the future, Synergy projects a continued robust growth trajectory, anticipating that the total capacity of hyperscale data centers will again double over the next four years. Each year is expected to see the addition of 120 to 130 new hyperscale facilities. Notably, the growth in hyperscale data center capacity is increasingly driven by the construction of even larger data centers. This scale-up is largely attributed to the needs imposed by generative AI technologies, which require immense computational power and data handling capabilities.

Synergy Research Group’s analysis encompasses the data center footprints of 19 of the world’s top cloud and Internet service firms. These include leaders in sectors such as Software as a Service (SaaS), Infrastructure as a Service (IaaS), Platform as a Service (PaaS), search engines, social networking, e-commerce, and gaming. Notably, the three hyperscale giants – AWS, Microsoft Azure, and Google Cloud – dominate the landscape, collectively accounting for 60% of all hyperscale data center capacity. These firms maintain a substantial presence not only in their home market in the U.S. but also across multiple international locations.

Following these leaders are other major tech companies like Meta (formerly Facebook), Alibaba, Tencent, Apple, and ByteDance, along with several smaller hyperscale data center operators. The aggressive expansion plans of these companies are evident in Synergy’s reported pipeline of future data centers, which includes 440 facilities at various stages of planning, development, and outfitting.

Chief Analyst at Synergy Research Group, John Dinsdale, stressed the complexity of these phenomena. He pointed out that self-owned data centers are usually bigger than leased ones, and that a hyperscale company’s domestic data centers are usually bigger than its foreign ones. There are frequently outliers to these trends, though. Mr. Dinsdale also highlighted a new trend: smaller facilities intended to bring infrastructure closer to clients are being deployed more frequently in tandem with the expansion of larger core data centers. This approach would seek to improve speed and lower latency in order to improve service delivery.