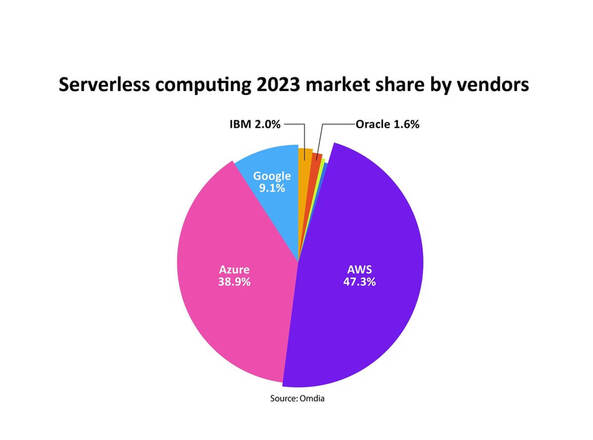

Serverless computing, a burgeoning sector within the cloud services domain, has surged to a market valuation of $19 billion, according to recent analysis from Omdia’s Cloud Software & Services Intelligence Service. Dominated by public cloud hyperscalers, this segment is led by Amazon AWS, which holds a commanding 47.3% market share, followed closely by Microsoft Azure at 38.9%.

Omdia’s projections indicate that the serverless computing market is poised for substantial growth, expected to reach $41 billion by 2028. This forecasted expansion represents a compound annual growth rate (CAGR) of 16.5%. Despite a slight dip in the growth rate between 2021 and 2023, Omdia anticipates a resurgence and acceleration in growth from 2024 onwards, driven significantly by AI workloads, which are projected to substantially boost cloud revenues.

The Serverless Computing Tracker 2024 by Omdia categorizes the serverless market into three main service areas: compute and DevOps tools, serverless storage, and application/service integration. The analysis reveals that serverless computing is being increasingly utilized, with at least a third of all cloud developers integrating serverless solutions into their operations. This trend is particularly notable among startups that lack data center expertise and prefer a fully serverless approach, thereby bypassing the need for extensive IT staffing and on-premises infrastructure.

Containers, DevOps Tools

Michael Azoff, Chief Analyst in Omdia’s Cloud and Data Center research practice, elaborates on the evolution of the serverless market. “The serverless market began as a straightforward Function-as-a-Service (FaaS) where developers could deploy code to be executed on a pay-as-you-go basis, typically rounded to the nearest millisecond. This model, where the host provider manages a multi-tenant compute architecture, has expanded rapidly to encompass a wide array of services. Workloads can now be run in containers, and a variety of developer and DevOps tools fall under what we term ‘Compute and DevOps’ tools.”

The demand for stateful services and robust storage solutions to handle data-intensive workloads has driven the development of serverless storage, marking it as the second major category in Omdia’s analysis. Furthermore, as developers strive to streamline application workflows and achieve seamless integration, Omdia‘s third category addresses these needs with integration tools.

Mr. Azoff emphasizes the significant revenue generated by serverless services for public cloud hyperscalers and acknowledges the complexity that newcomers face in navigating the diverse array of available options. “With serverless now widely adopted, our upcoming Serverless Tracker Analysis report will provide enterprises with essential guidelines for leveraging these services successfully,” he concludes.