Spending on compute and storage infrastructure products for cloud deployments, like dedicated and shared IT environments, rose 36.9% year over year to $33.0 billion in the first quarter of 2024 (1Q24), according to IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment. As expected, spending on cloud infrastructure continues to grow faster than spending on non-cloud infrastructure, which grew by 5.7% in 1Q24 to $13.9 billion.

Unit demand grew more slowly in the cloud infrastructure segment, by 11.4%. This is because average selling prices (ASPs) kept going up, mostly because of more GPU servers being shipped than normal.

“AI-related investments are continuing to drive cloud infrastructure spending growth,” said Juan Pablo Seminara, Research Director for IDC‘s Worldwide Enterprise Infrastructure Tracker. “These investments are having a positive effect not only on servers but also on enterprise storage. AI investment plans are not slowing down in 2024, even though there is still some social and political uncertainty. They will continue to grow quickly this year and beyond.”

The better economic outlook would also make the spending forecast very good for 2024 and 2025, when cloud-based spending will grow at a double-digit rate.

In the quarter, $26.3 billion was spent on shared (public) cloud technology, which is 43.9% more than the same time last year. When comparing spending, dedicated (private) cloud deployments, non-cloud spending, and shared cloud assets continue to have the most money spent on them. 56.1% of all infrastructure spending in 1Q24 went to shared clouds. This part of the market, dedicated cloud infrastructure, grew less than the rest, by 15.3% year over year in 1Q24, reaching $6.7 billion.

IDC thinks that spending on cloud infrastructure will rise 26.1% from 2023 to 2024, reaching $138.3 billion. It’s expected that equipment that isn’t in the cloud will grow 8.4% to $64.8 billion. We think that shared cloud infrastructure will reach $108.3 billion, up 30.4% from last year. The amount spent on dedicated cloud infrastructure is also expected to grow by more than 10% in 2024, hitting $30 billion for the whole year. It is expected that non-cloud infrastructure will grow only 8.4% in 2024. This means that most of the growth will come from spending on the cloud, but general non-cloud dedicated systems will start to return this year.

Service Provider Spending

IDC groups cloud service providers, digital service providers, communications service providers, hyperscalers, and managed service providers into the service provider category. Service providers spent $32.2 billion on computing and storage equipment in the first quarter of 2423, which is 37.9% more than the same time last year. 68.7% of the market was made up of this spending. Non-service providers, like businesses, the government, and others, also spent more, bringing the total to $14.7 billion, up 5.8% year over year. Service companies will spend $132.2 billion on compute and storage in 2024, up 26.2% year over year, according to IDC.

Overall, year-over-year spending on cloud infrastructure in the first quarter of 2423 was very good. Only Latin America saw a decrease of 2.8%, while Western Europe and the Middle East and Africa were the only areas to see growth in the single digits, at 4.0% and 5.3%, respectively.

Political conflicts that slowed down plans to make investments had a big impact on these results. Asia/Pacific (except Japan and China), Japan, Central & Eastern Europe, the USA, China (PRC), and Canada all saw strong double-digit growth in cloud spending. Year over year, these areas saw growth of 85.4%, 53.1%, 42.6%, 37.0%, 33.7%, and 16.1%, respectively. A lot of the growth is due to big projects that use high performance computing (HPC) and artificial intelligence (AI). Some of these projects were held up in the past because of supply problems.

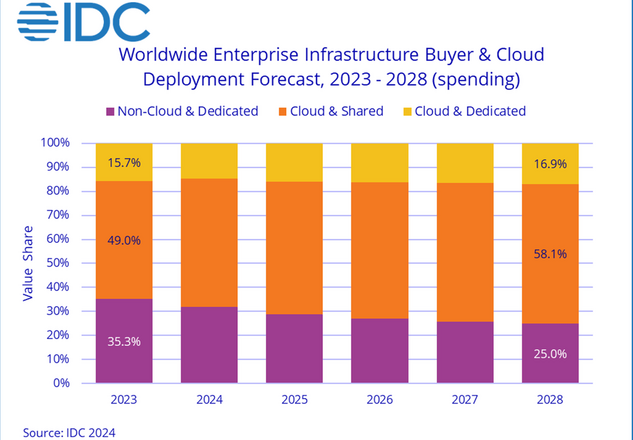

IDC thinks that spending on cloud infrastructure will grow at a rate of 14.3% per year from 2023 to 2028, hitting $213.7 billion in 2028 and making up 75.0% of all spending on compute and storage infrastructure. By 2028, shared cloud infrastructure spending will make up 77.5% of all cloud spending, growing at a 14.8% CAGR to $165.6 billion. Dedicated cloud infrastructure costs will rise at a rate of 12.6% per year, reaching $48.2 billion. Spending on infrastructure that isn’t in the cloud will also rise, with a 3.6% CAGR that will hit $71.4 billion in 2028. It is estimated that service providers will spend $199.9 billion on compute and storage infrastructure by 2028, up 13.8% annually.

IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment is meant to help businesses learn more about what percentage of the market for computing and storage gear is being used in the cloud. The Tracker separates each vendor’s income into shared and private cloud environments for past data and gives a prediction for the next five years. This report is part of the Worldwide Quarterly Enterprise Infrastructure Tracker, which looks at the entire market for the four main technologies that make the data center work: servers, external enterprise storage systems, purpose-built appliances (HCI and PBBA), and more.

Notes on Taxonomy

IDC gives a more official definition of cloud services by making a list of key features that a service must have for end users.

Shared cloud services are used by businesses and consumers that are not connected to each other. They are open to a wide range of possible users and are meant for a market, not just one business. The market for shared clouds has many services that can add to or even replace IT infrastructure in company datacenters. All of these services together are known as public cloud services. Digital services like e-commerce, social media, and sharing and searching for media and information are also part of the shared cloud market.

Dedicated cloud services are shared within a single enterprise or an extended enterprise, with limits on who can access them and how much of their resources can be used. These services are defined and controlled by the enterprise, giving it more power than with public clouds. They can be located on-site or off-site, and they can be managed by in-house or external staff. “Vendors (cloud service providers)” are the same as the IT departments or shared service departments in businesses or groups that run a dedicated cloud that is handled by in-house staff. People who work for the company or group and use standard services are called ‘service users.’ These people include business departments, offices, and workers.